micro assurance sante

PROMO CODE DRC-CARTE-VITALITE

Cliquez ci-dessous pour bénéficier de votre offre : 2 mois gratuits. Nous vous contacterons ensuite pour répondre à toutes vos questions.

carte vitalite

Cliquez ici pour choisir votre Plan et effectuer votre paiement.

Sélectionnez le plan qui vous convient le mieux et finalisez votre inscription en toute sécurité.

À propos de nous

Bienvenue - Carte Vitalité Micro Assurance Santé!

Là où votre santé et votre tranquillité d’esprit sont nos priorités absolues — nous vous proposons des solutions d’assurance santé personnalisées pour protéger ce qui compte le plus : vous et vos proches.

Couverture santé complète

Efficacité Optimale pour les Hôpitaux

Autonomie et la Simplicité pour les Patients

Ils nous font confiance

CARTE VITALITE

Cliquez ci-dessous pour vous inscrire!

Remplissez le formulaire et vous recevrez un e-mail de confirmation.

CARTE VITALITE

Difficile de se décider concernant nos services ? Ne vous inquiétez pas. Notre conseiller en assurance procédera probablement à un examen complet de votre situation financière, vous posera des questions sur vos antécédents médicaux. Il pourra également évaluer les aspects suivants :

Couverture complète: Bénéficiez d’une protection étendue pour les consultations médicales, les séjours à l’hôpital, les médicaments sur ordonnance et les soins préventifs pour vous et votre famille.

Accès aux meilleurs prestataires de santé: Soyez pris en charge par un large réseau de médecins, spécialistes et établissements médicaux de confiance, avec un minimum de démarches et de temps d’attente.

Plans abordables: Choisissez parmi des plans flexibles et adaptés à votre budget sans compromettre la qualité des soins.

Tranquillité d’esprit: Concentrez-vous sur votre santé et votre bien-être en sachant que vous êtes pleinement soutenu en cas de maladie ou d’urgence médicale imprévue.

Questions Fréquemment Posées

Quels services propose Carte Vitalité ?

Nous proposons une large gamme de plans d’assurance, y compris santé, dentaire, vision, et famille, adaptés à vos besoins.

Comment puis-je faire une réclamation ?

Vous pouvez soumettre une réclamation en ligne via notre Centre de solutions ou contacter notre équipe d’assistance pour obtenir de l’aide.

Les plans Carte Vitalité sont-ils disponibles pour les particuliers et les familles ?

Oui, nous offrons des options d’assurance flexibles pour les particuliers, les familles et les entreprises.

Comment obtenir un devis ?

Rendez-vous simplement sur notre site web et cliquez sur « Obtenir un devis » pour recevoir un plan d’assurance personnalisé adapté à votre budget et à vos besoins. Ou téléchargez notre application Carte Vitalité.

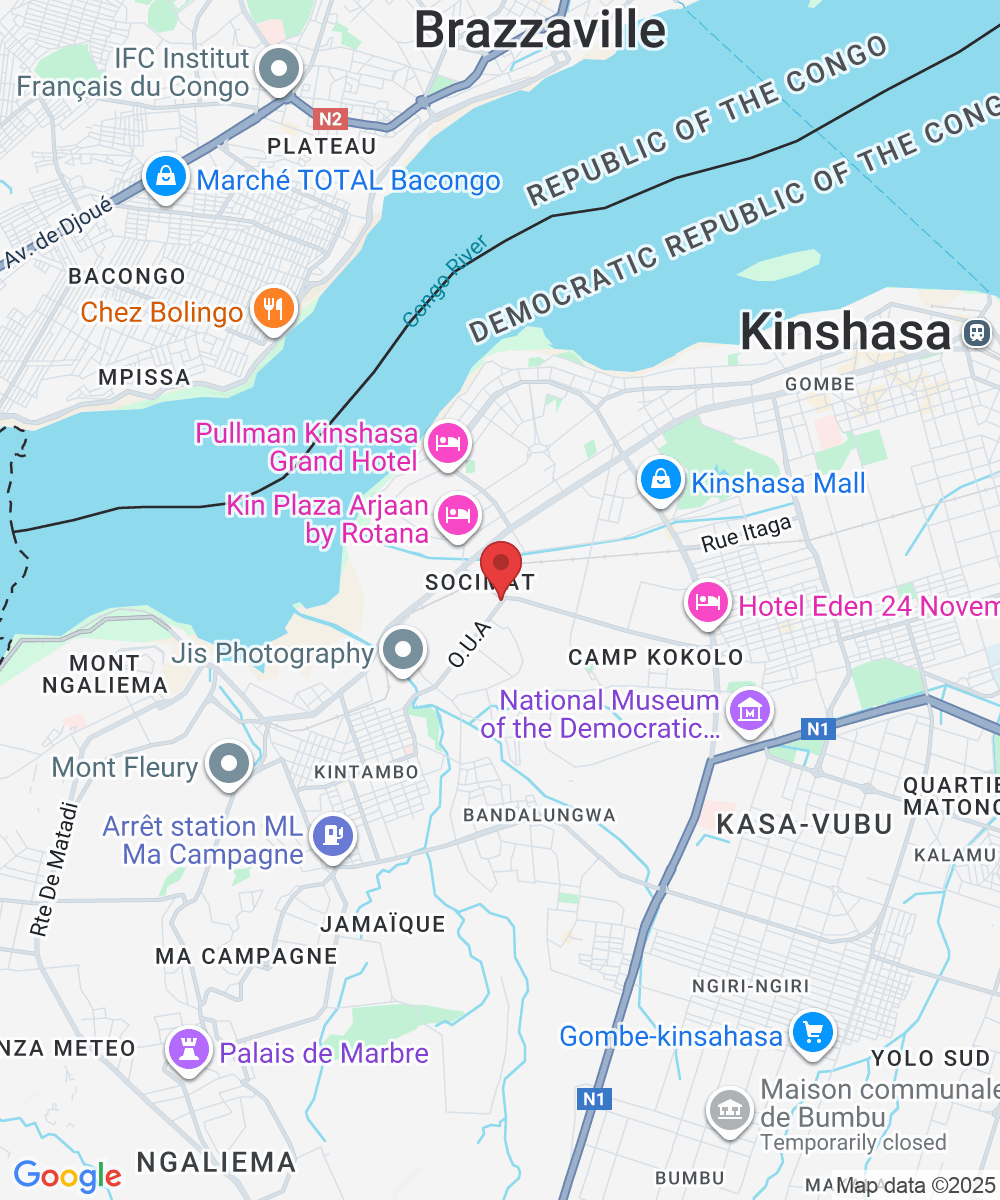

Adresse: Av des cliniques numéro 32 bis commune de la Gombe, Kinshasa Kinshasa 2000

Appel: +243827695859

Email: [email protected]

Site: https://cartevitalite.com/